Phygital: The next chapter in the Financial Services & Insurance Sector!

SalesPanda’s Digital Branch and Digital Office model can help financial services and insurance companies expand their geographical reach by overcoming distribution challenges.

TL;DR

Phygital (Physical+Digital) can be the next revolutionary thing for Financial Services and Insurance:

- The financial services and insurance sectors have been some of the early adopters of digital initiatives, but there is still potential unexplored to break through the masses. This reluctance needs awareness of how and why the problem needs to be solved.

- SalesPanda’s Digital Branch model helps bridge this gap by overcoming geographical barriers.

- The Digital Office initiative makes it possible for every partner with the potential to leverage digital for better reach, growth and revenue.

Introduction

Being one of the largest sectors, the financial services and insurance industry brings great potential for economic growth and development. However, it has always been challenged by the last-mile penetration and financial inclusion of the smaller regions. While in urban areas for the high-income strata, the reach to any form of insurance and financial services products and support has been highly convenient due to the balance between physical and digital initiatives, the lower strata of the population still depend on informal sources, friends or other family members to meet their financial needs.

Why?

There can be many reasons, but some of the prominent ones can be – the high cost of services, resource challenges, connectivity challenges, leveraging local/regional partner networks, physical branch reach and lack of awareness.

Hence to achieve this objective, here are some propositions (a) Customisation of insurance and financial products for the lower strata of the population. (b) Expansion of geographical boundaries. (c) Embracing phygital (physical+digital) model. (d) Enabling well-equipped partner networks that are the most trusted initial source to gain information and awareness about financial services and insurance products.

So, how to build this ecosystem?

India is a country with a large population and easy access to internet connectivity. Hence, leveraging this connectivity with digital initiatives can increase the low financial and insurance product penetration rate, given the immense market size. Also, awareness is another pain area where digital initiatives can be a highly effective tool to address it.

This is where SalesPanda can be a valuable contributor. How?

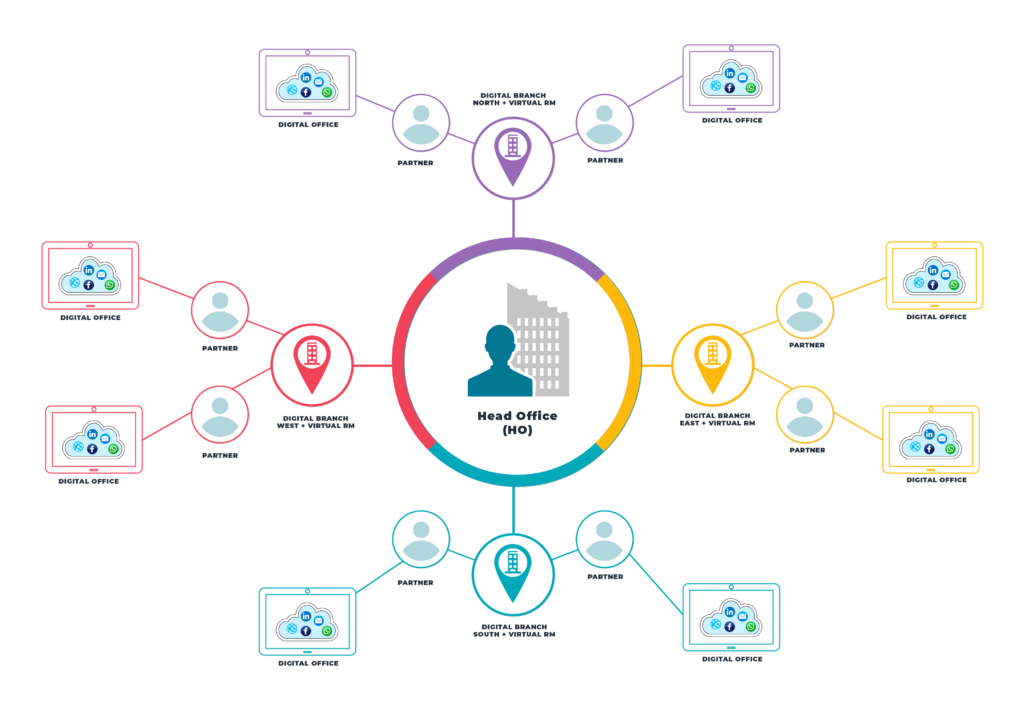

SalesPanda brings you a Digital Branch (Digibranch) module where financial services companies can set up digital branches across geographies supported by a well-integrated Digital Office. These digital branches are further backed by a Virtual Relationship Manager (VRM) to provide consistent support and guidance to the partner networks and customer queries.

Essentially, SalesPanda is a sales enablement and acceleration platform helping enterprises with channel-driven businesses become digitally enabled and leverage their reach with effective sales and marketing automation. It’s a well-integrated platform with features that help boost the productivity and performance of sales and partner networks (agents, distributors, sellers, advisors, etc). The platform can effectively help BFSI companies overcome three main pain areas – 1) Distribution reach expansion. 2) Consistent customer engagement, experience & brand awareness. 3) Compliance, control and visibility.

And, how does it work?

We provide a platform where the Head Office can create Digital Branches across geographies aligning a virtual relationship manager with each digital branch.

These virtual relationship managers (VRMs) are well-equipped and informed to support partners in the area. Further, each partner in the area gets their personalised Digital Office.

The infographic mentions two very important terms- Digital Branch and Digital Office. Let’s understand what they mean.

What is a Digital Branch (DigiBranch)?

A digital branch is a virtual portal designed to overcome geographical barriers for BFSI companies that want to increase their distribution reach and awareness about financial products. The module provides the capability to create cost-efficient digital branches across various regions while aligning a virtual relationship manager (VRM) to assist the partners as well as customers with any queries. Digital branches also empower the partners in the region to stay informed, updated and aware of the product and business-related information. They can timely access localised and branded content to engage customers consistently.

Key Elements of a Digital Branch:

-> Branch Microsite- It’s a web portal with a unique URL that’s assigned to the branch in the area, just like a physical one where customers as well as partners can come for queries and support but is highly cost-effective and better connected.

-> Branded Content- A well-equipped library with local campaigns and content to cater for the needs and requirements of the customers in the region.

-> Training for Partners- To provide a better understanding of the product-related updates, and knowledge sharing to pitch better.

-> Customer Support- To guide and assist customers if they reach out to the digital branch and resolve their queries.

-> Partner Support- To assist partners with content-related queries, feature-related queries, incentive or rewards-related queries and more.

What is a Digital Office?

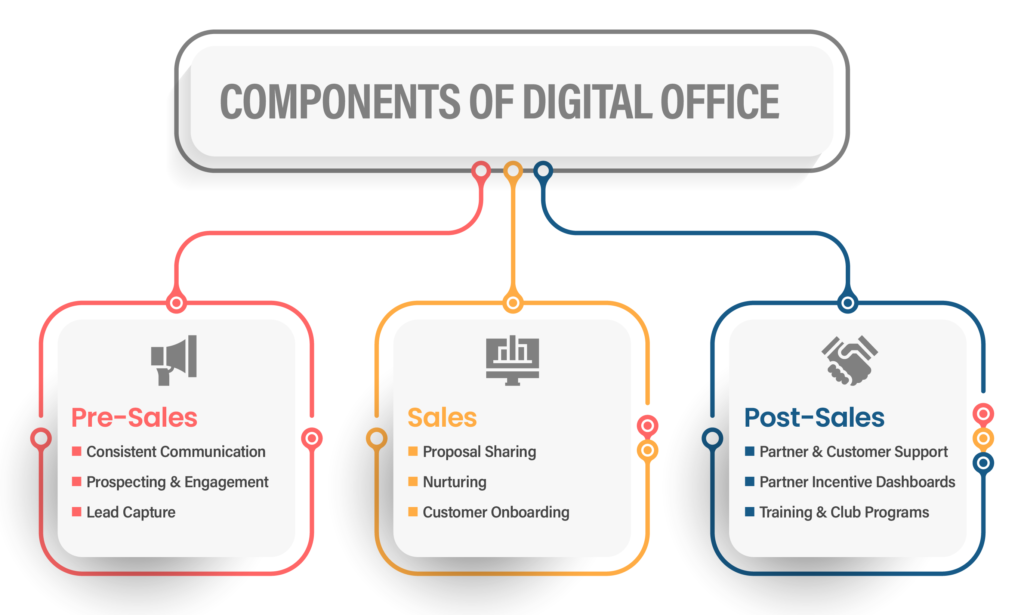

Digital Office is an all-in-one platform provided to each partner associated with each digital branch on both mobile and web. It is a comprehensive blend of 3 different components – Pre-Sales, Sales and Post Sales.

Here the partner gets a Personalised Business Microsite with their details, lead forms, chatbot, and WhatsApp button for lead capture; Co-branded Content Library with regularly updated latest content and campaigns; Automated Social Media and Email Marketing Campaigns to run localised campaigns at a centralised level to nurture and keep the relationship going with customers; Training and Coaching for knowledge sharing to help partners pitch better; CRM with Digital Diary to monitor and manage contacts, prospects and leads while maintaining day-to-day tasks with timely reminders to never miss out on a sales conversion opportunity.

In the case of recruits, the platform also provides capabilities with an easy onboarding process where companies can guide, train and coach them to understand the products and ways to pitch effectively.

What’s in it for Financial Services and Insurance Companies?

a. Visibility and Reach- The current market demands the insurance and financial sector expand its distribution partnership. Hence, onboarding and enabling partners across regions will not only provide higher product penetration but also increase sales volume while adding business value. The platform helps maintain brand consistency and control as it provides visibility at a central level where they can manage and overview everything happening at the branch and partner levels.

b. Omnichannel approach for improved customer experience- As insurance and financial services companies focus on integrating systems and platforms to create the ability for partners, they also provide them with the ability to have seamless conversations across multiple channels with customers. For instance, if a partner is engaging a customer via email campaigns and WhatsApp, it’s highly likely that if someday the customer intends to buy an insurance policy or plans an investment will consider reaching out to this partner for advice and based on the interest, the partner can provide a better and more personalised quote for this customer. Similarly, if the customer reaches out to the digital branch with a product inquiry, the virtual RM can directly assign this lead to the nearest partner for resolution. This approach is not only helping financial services companies build brand trust and customer experience but also helps save costs.

c. Insights and analytics- All the activities performed at the branch, as well as partner level, can be measured with a detailed centralised dashboard. Here head office can see the digital branch’s activity, and evaluate partners’ productivity, content sharing, campaign engagement, performance and more. The aim is to provide business intelligence that can provide better decision-making capabilities and drive faster results for business growth.

Would you be interested in exploring our platform and how it can fit into the growth strategy of your business goals? Write to us at marketing@salespanda.com.